(Amendment No. ___)

| Preliminary Proxy Statement | ||

| Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| Definitive Proxy Statement | ||

| Definitive Additional Materials | ||

| Soliciting Material Pursuant to §240.14a-12 | ||

| No fee required. | |||||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||

| ) | Title of each class of securities to which transaction applies: | ||||

| (2 | ) | Aggregate number of securities to which transaction applies: | |||

| (3 | ) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4 | ) | Proposed maximum aggregate value of transaction: | |||

| (5 | ) | Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | ||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||

| ) | Amount previously paid: | ||||

| (2 | ) | Form, Schedule or Registration Statement No.: | |||

| |||||

| ) | Filing Party: | ||||

| (4 | ) | Date Filed: | |||

May FARO Technologies, Inc. 250 Technology Park, Lake Mary, Florida 32746 Proposals Election of the following persons as directors: • • Yuval Wasserman Non-binding vote to approve the compensation of our named executive officers FARO TECHNOLOGIES, INC.250 Technology ParkLake Mary, Florida 32746NOTICE OF

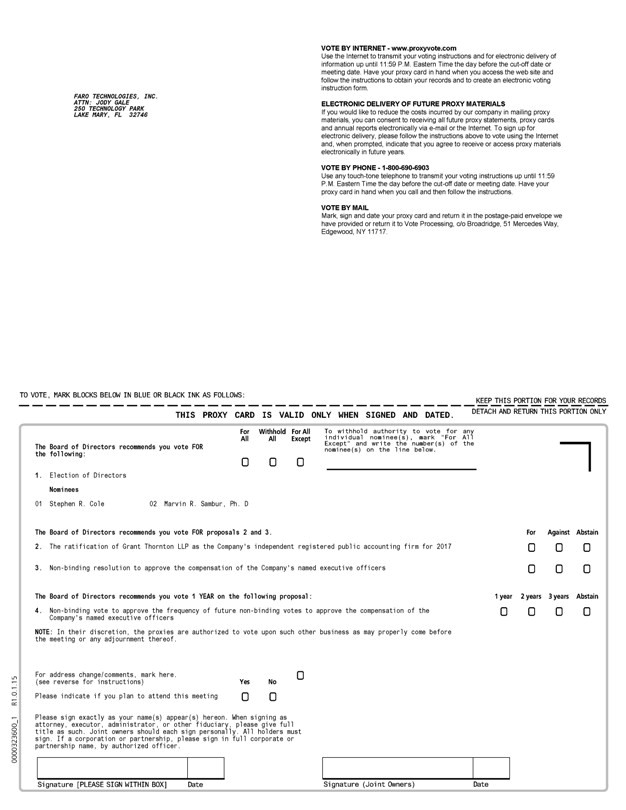

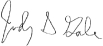

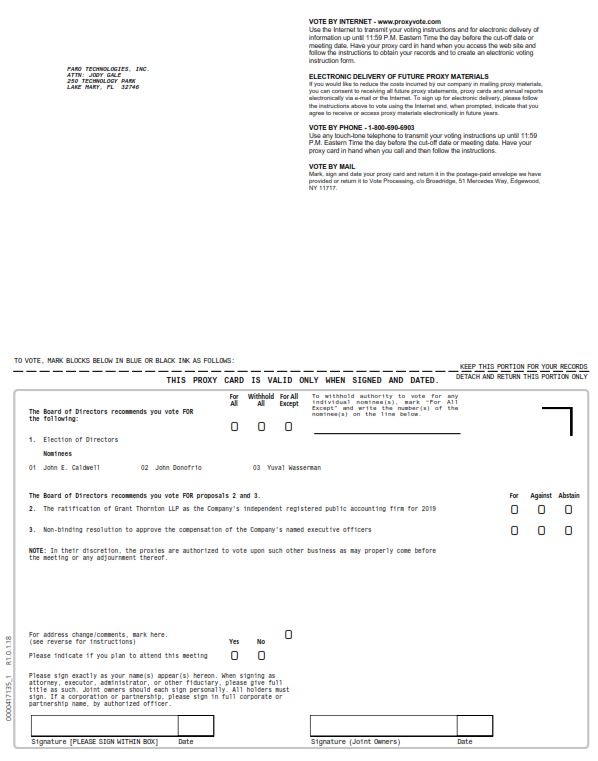

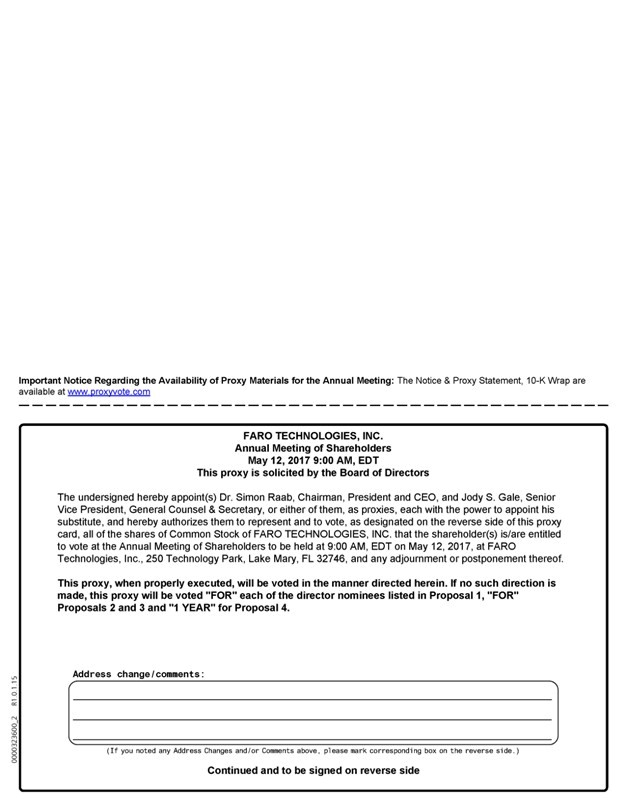

FARO TECHNOLOGIES, INC.250 Technology ParkLake Mary, Florida 32746NOTICE OF 20172019 ANNUAL MEETING OF SHAREHOLDERSTO BE HELD ON MAY 12, 201730, 2019March 31, 2017April 17, 2019To our shareholders:You are cordially invited to attend the 2017 2019Annual Meeting of Shareholders (the “Annual Meeting”) of FARO Technologies, Inc. (the “Company,” “FARO,” “we,” “us” or “our”) on May 12, 201730, 2019 at 9:00 a.m., Eastern time, at our principal executive offices, located at 250 Technology Park, Lake Mary, Florida 32746. At the Annual Meeting, shareholders will vote on the following matters:1. the election of twothree directors, Stephen R. ColeJohn E. Caldwell, John Donofrio and Marvin R. Sambur, Ph.D.,Yuval Wasserman, to the Board of Directors, each to serve for a three-year term expiring at the Annual Meeting of Shareholders in 2020;2022;2. the ratification of Grant Thornton LLP as our independent registered public accounting firm for 2017;2019;3. a non-binding resolution to approve the compensation of our named executive officers; 4.a non-binding vote as to the frequency with which shareholders will vote on the compensation of our named executive officers in future years; and5.4. any other business that may properly come before the Annual Meeting or any postponements or adjournments of the Annual Meeting. Holders of record of FARO common stock at the close of business on March 17, 201729, 2019 are entitled to vote at the Annual Meeting.FARO is pleased to be providing access to our proxy materials primarily by taking advantage of the Securities and Exchange Commission rule that allows issuers to furnish proxy materials to their shareholders over the Internet. On or about March 31, 2017, the CompanyApril 17, 2019, we will mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to the majority of itsour shareholders, and on or about the same date, the Companywe will mail a printed copy of the proxy statement and a proxy card to shareholders who have requested to receive them. On the mailing date of the Notice, all shareholders will have the ability to access all of the proxy materials, including the proxy statement, on a website referred to in the Notice and the proxy statement. The Company believesWe believe this method allows the Companyus to provide you with the information you need more expeditiously, while lowering the costs of delivery and reducing the environmental impact of the Annual Meeting.Your vote is important, and it is important that your shares be represented at the Annual Meeting, no matter how many shares you own. Please promptly submit your proxy or voting instructions over the Internet or by telephone by following the instructions on the Notice and in the proxy statement so that your shares can be voted, regardless of whether you expect to attend the Annual Meeting. If you received your proxy materials by mail, you may submit your proxy or voting instructions over the Internet or by telephone, or you may submit your proxy by marking, dating, signing and mailing the proxy card or voting instruction card using the postage paid envelope provided. If you attend the Annual Meeting, you may withdraw your proxy and vote in person if you would like to do so.Thank you for your continued support. By Order of the Board of Directors,

JODY S. GALE Senior Vice President, General Counsel and Secretary

2017 2019 Proxy Statement SummaryThe following is a summary of certain key disclosures in this

2019 Proxy Statement SummaryThe following is a summary of certain key disclosures in this proxy statement.Proxy Statement. This is only a summary, and it may not contain all of the information that is important to you. For more complete information, please review this proxy statementProxy Statement as well our 20162018 Annual Report on Form 10-K.Annual Meeting of Shareholders12, 2017,30, 2019, 9:00 a.m. Eastern Time Record Date: March 17, 201729, 2019 Proposals to be Voted on and Board Voting RecommendationsRecommendations Recommendations• Stephen R. Cole • John E. Caldwell FOR Marvin R. Sambur, Ph.D.John Donofrio FOR FOR Ratification of Grant Thornton LLP as Auditors for 20172019 FOR FOR Non-binding vote as to the frequency with which shareholders will vote on the compensation of our named executives officers in future yearsFOR EVERY ONEYEAR20162018 HighlightsIn 2016,2018, we reorganizedcrossed the $400 million milestone in annual sales for the first time in our businesshistory. We recorded $403.6 million in total sales in 2018, an increase of 11.8% over 2017. We achieved over $425 million in new order bookings in 2018, up 12.8% compared to align2017. We executed on our strategic sales growth initiative by expanding our sales marketing,organization headcount 16.2% compared to the end of 2017. We maintained a strong balance sheet with no debt and cash and cash equivalents and short-term investments of $133.6 million as of December 31, 2018.We achieved numerous milestones in 2018 involving significant product managementlaunches and research and development to specific vertical markets to better define our end market applications. We believe this realignment will enable us to focus our product offerings and selling approach to meet the specific needs of our customers. Sales for fiscal year 2016 were $325.6 million, up 2.5% from fiscal year 2015. Operating income for fiscal year 2016 was $13.3 million, up 1.2% compared with the prior year, while net income of $11.1 million was $1.7 million lower than fiscal year 2015. Although our financial results did not meet our aggressive internal targets, there were a number of highlights in 2016:acquisitions:Product innovation – In 2018, we launched fourteen new products including:•◦ Going Vertical in Harmony Reorganization Initiative—AsFARO ScanPlan – The FARO ScanPlan is a result of the reorganization, we realigned our business into the following three reportable segments, which incorporate our specific vertical markets:¡Factory Metrology—provides solutions for manual and automated measurement and inspection in an industrial or manufacturing environment;¡Construction Building Information Modeling—Construction Information Management—provides solutions for as-built datahandheld mapper that captures two-dimensional (“2D”) floor plans. The FARO ScanPlan performs real-time capturing and three-dimensional (“3D”) visualization in building information modelingdiagramming of as-built floor plans of buildings for threat assessment, pre-incident planning and fire protection engineering.◦ FARO TracerSI – The FARO TracerSI accurately projects a laser line onto a surface or construction information management applications, allowing our customers in the architecture, engineeringobject, providing a virtual template that operators and construction marketsassemblers can use to quickly and accurately extract desired two-dimensionalposition components with confidence. ◦ FARO Design ScanArm®2.5C and 3D measurement points; and¡Other—the Other segment includes our Product Design, Public Safety Forensics and 3D Solutions vertical organizations.

|

FARO |

|

ScanArm. Using the new FARO |

| ◦ | FARO 8-Axis FaroArm®–This |

| ◦ | 6DoF FARO Vantage Laser Tracker – Together with the hand-held 6Probe, a fully-integrated hand-held probe, the 6DoF FARO Vantage Laser Tracker |

| ◦ | FARO Digi-Cube®– FARO Digi-Cube® is a high-precision, high |

| ◦ |

| ◦ |

|

Leadership Transition

In December 2015, we announced the appointment of Dr. Simon Raab, our co-founder and Chairman, as interim President and Chief Executive Officer coinciding with the resignation of Jay Freeland, who had served as our President and Chief Executive Officer since 2006. In 2016, we announced Dr. Raab’s commitment to extend his role as President and Chief Executive Officer beyond an interim basis until the completion of our Going Vertical in Harmony reorganization initiatives and the realization of our near-term strategic priorities.

In March 2016, we announced the resignation of Laura A. Murphy-Wolf, who had served as our Senior Vice President and Chief Financial Officer since August 2015. In December 2016, we announced the promotion of Robert E. Seidel to Chief Financial Officer.

In April 2016, in connection with our Going Vertical in Harmony reorganization initiatives, we announced the appointments of Kathleen J. Hall as our Chief Operating Officer and Joseph Arezone as our Chief Commercial Officer.

Compensation Highlights

The

time-based restricted stock units. We did not meet anyall of the financial goals we set for ourselves in 2018, and thus did not meet the minimum payout thresholds under our 2016 short-term incentive plan.

However, in recognition of the significant efforts required from our employees to successfully execute our Going Vertical in Harmony reorganization initiatives, as described in “Executive Compensation—Compensation Discussion and Analysis,” the Compensation Committee approved a discretionary cash bonus to our employees entitled to receive bonuses, including our named executive officers of up to 35%earned only between 11.50% and 12.65% of their target short-term incentive compensation.

Our Board of Directors consists of Executive sessions of the independent directors are held at each in-person Board meeting. We have a director resignation policy for those director nominees who receive more President and Chief Executive Officer TransitionOn January 9, 2019, we entered into a letter agreement with Dr. Simon Raab, setting forth the terms of Dr. Raab’s retirement as our President and Chief Executive Officer (“CEO”) and as a member of our Board of Directors. Dr. Raab agreed to continue to serve as our President and CEO and to remain on our Board of Directors until the appointment of his successor. On April 5, 2019, our Board of Directors appointed Michael D. Burger as our President and CEO, effective as of June 17, 2019. Mr. Burger has over 20 years of experience as a global executive in the industrial technology segment. Mr. Burger’s background is discussed in more detail on page 26 of this Proxy Statement. In connection with Mr. Burger’s appointment, Dr. Raab will retire as our President and CEO and as a member of our Board of Directors on June 16, 2019. The Compensation Discussion and Analysis section of this Proxy Statement has more information regarding the compensation payable to Dr. Raab during this transition period pursuant to the letter agreement and the compensation payable to Mr. Burger upon the commencement of his service as our President and CEO. In addition, on April 5, 2019, the Board elected John Donofrio to serve as the independent Chairman of the Board, effective immediately.Corporate GovernanceOur corporate governance policies reflect many components of what are widely considered to be best practices:sixseven members, comprised of fivesix independent directors and our Chief Executive Officer.President and CEO. Only the independent directors serve on the Audit, Compensation, and Governance and Nominating, and Operational Audit Committees.Hedging transactionsOur Company policy prohibits hedging and pledging of Company securities by our stock are prohibited for all directors and executive officers.SignificantWe have a stock ownership requirements are in placepolicy for our non-employee directors and executive officers. Under these guidelines,officers, as further described on pages 19 and 39 of this Proxy Statement, respectively. Among other things, this policy provides that our Chief Executive Officer is required to own stock having a value equal toPresident and CEO must hold at least six times his annual base salary thein Company common stock, our other executive officers are required to own stock having a value equal toexecutives must hold at least two times their respective annual base salaries in Company stock, and our non-employee directors are required tomust own Company stock havingwith a value equal toof at least $300,000.OurWe maintain a compensation clawback policy, applies to executive officers’ performance-based incentive compensation in the eventas further described on page 39 of a restatement of our financial statements due to misconduct.“withheld”“withhold” than “for” votes in uncontested elections.

We were pleased that

TABLE OF CONTENTS2018 say-on-pay voting results, shareholder outreach considerations and recommendations for the 2019 long-term equity incentive award design. As a result of this initiative, the Compensation Committee approved the following significant changes to our executive compensation to more closely align with current best practices, respond to shareholder concerns regarding the pay-for-performance features of our executive compensation programs, and strengthen the pay-for-performance alignment of our executive compensation programs, as described in more detail in our Compensation Discussion and Analysis in this Proxy Statement:

| Prior Approach | What We Heard | Our Actions |

Short-term cash incentives could be earned based on the achievement of established performance metrics; however, the Compensation Committee had discretionary authority to increase (or decrease) the amount earned. The Compensation Committee approved discretionary cash bonuses to be paid to our named executive officers for 2017 even though the performance requirements were not met under our short-term cash incentive plan. | Annual cash bonus awards are not tied to the achievement of established performance metrics. | For 2018, the short-term cash incentive plan had pre-established performance metrics, consisting of sales growth and operating income. In determining the bonuses earned by, and paid to, our named executive officers based on 2018 performance, these performance metrics were strictly adhered to, and no discretionary bonuses were awarded to our named executive officers for 2018. |

| Our long-term incentive compensation in recent years consisted of a mix of stock options and restricted stock units, both subject to only time-based vesting. | Long-term incentive compensation is not tied to objective performance metrics. | For 2019, the Compensation Committee redesigned the long-term equity incentive awards granted to our named executive officers to eliminate the use of stock options and introduce performance-based restricted stock units. |

| The Compensation Committee adjusted the mix and vesting of the equity awards granted to our named executive officers in 2019 as follows: (1) 50% of the value of the equity awards was in the form of performance-based restricted stock units, which vest at the end of three years based on the satisfaction of pre-established goals related to our total shareholder return (“TSR”) compared to the TSR of the companies in the Russell 2000 Growth Index; and (2) 50% of the value of the equity awards was in the form of time-based restricted stock units that vest in equal installments over three years. | ||

2017

| 1. | the election of |

| 2. | the ratification of Grant Thornton LLP as our independent registered public accounting firm for |

| 3. | a non-binding resolution to approve the compensation of our named executive |

April 17, 2019.

The Notice of 20172019 Annual Meeting of Shareholders;

This Proxy Statement for the Annual Meeting; and

Our 20162018 Annual Report, which includes our Annual Report on Form 10-K for the year ended December 31, 2016,2018, as filed with the SEC on February 24, 201721, 2019 (the “Annual Report”).

and mailing costs. Shareholders who participate in householding will continue to receive separate proxy cards if they received a printed set of the proxy materials. Upon written or oral request, we will deliver promptly a separate copy of the Notice and, if applicable, this Proxy Statement and the Annual Report to any shareholder at a shared address to which we delivered a single copy of any of these documents.

View our proxy materials for the Annual Meeting; and

Instruct us to send future proxy materials to you by e-mail.

give instructions to your bank or brokerage firm, it will nevertheless be entitled to vote your shares with respect to “routine” items, but it will not be permitted to vote your shares with respect to “non-routine” items. In the case of a non-routine item, your shares will be considered “broker non-votes” on that proposal.

over the Internet, through the website shown on your Notice or proxy card;

by telephone, by calling toll-free 1-800-690-6903 in the United States from any touch-tone telephone and following the instructions; or

If you received a printed set of proxy materials, by mailing your signed proxy card in the postage paid envelope provided.

How many shares must be present to consider each matter at the Annual Meeting?

The presence, in person or by proxy, of a majority of the votes entitled to be cast on a specific proposal will constitute a quorum for that proposal. Even if a quorum is established for the Annual Meeting, it is possible that a quorum may not be established for a specific proposal presented at the Annual Meeting. Shares that are voted “ABSTAIN” or properly executed proxy cards or voting instructions cards that are returned without voting instructions will be counted as present for the purpose of determining whether the quorum requirement is satisfied for all proposals at the Annual Meeting. If your shares are held in street name and you do not provide voting instructions to your bank or broker, your shares will not affect the determination of whether a quorum exists for Proposals 1, 3 or 4, but your shares will be counted as present for the purpose of determining whether the quorum requirement is satisfied for Proposal 2.

FOR the election of Stephen R. ColeJohn E. Caldwell, John Donofrio, and Marvin R. Sambur, Ph.D.Yuval Wasserman to the Board of Directors;

FOR the ratification of Grant Thornton LLP as our independent registered public accounting firm for 2017;

FOR the approval of the compensation of our named executive officers; and

FOR an annual non-binding vote to approve the compensation of our named executive officers.

If you are a registered shareholder and you do not vote, your un-voted shares will not count toward the quorum requirement for the Annual Meeting or any proposal considered at the Annual Meeting. If a quorum is obtained, your un-voted shares will not affect the outcome of any proposal.

properly completing and signing another proxy card with a later date and returning the proxy card prior to the Annual Meeting;

voting again by telephone or the Internet until 11:59 pm, Eastern time, on May 11, 2017;

giving written notice of your revocation to FARO Technologies, Inc., Attention: Secretary, 250 Technology Park, Lake Mary, Florida 32746, prior to or at the Annual Meeting; or

voting in person at the Annual Meeting.

Proposal 4—FOR an annual non-binding vote to approve the compensation of our named executive officers.

election of directors.

How many votes are required to approve the non-binding vote as to the frequency with which shareholders will vote on the compensation of the Company’s named executive officers in future years?

Shareholders may select a frequency of every one, two or three years, or they may abstain from voting on this proposal. The non-binding selection of one of the three frequency options requires the affirmative vote of a majority of the votes cast by the shareholders. If none of the frequency options receives the approval of a majority of the votes cast, the Board will view as the selection of the shareholders the frequency alternative that receives the greatest number of votes. Abstentions and broker non-votes will have no impact on the outcome of this matter.

However, we reserve the right not to forward to Board members any abusive, threatening or otherwise inappropriate materials.

shareholders.

Dr. Raab will retire from the Board on June 16, 2019 upon his retirement as our President and CEO.

We have a director resignation policy for those director nominees who receive more “withhold” than “for” votes in uncontested elections, which requires such director nominees to tender their resignation to the Board following certification of the shareholder vote. The Governance and Nominating Committee will then act to determine whether to accept the director’s resignation and submit such recommendation for prompt consideration by the Board.

Name | Age | Director Since | Term Expires | Position | ||||||||||

Stephen R. Cole | 65 | 2000 | 2020 | Director and Nominee | ||||||||||

Marvin R. Sambur, Ph.D. | 71 | 2007 | 2020 | Director and Nominee | ||||||||||

| Name | Age | Director Since | Term Expires | Position | |||||

| John E. Caldwell | 69 | 2002 | 2022 | Director and Nominee | |||||

| John Donofrio | 57 | 2008 | 2022 | Director and Nominee | |||||

| Yuval Wasserman | 64 | 2017 | 2022 | Director and Nominee | |||||

Chartered Institute of Business Valuators, Senior Member of the American Society of Appraisers and Full Member of the ADR Institute of Canada, Inc. He is currently a director and chairman of the compensation committee of Westaim Corporation, a TSX Venture Exchange listed company. Previously, Mr. Cole was a director of H. Paulin & Co. Limited, a Toronto Stock Exchange (“TSX”) listed company, where he also served as chairman of the audit committee. Mr. Cole has also held a position as an advisory committee member or director of various private companies and charitable and professional organizations.

Relevant experience and skills: mergers and acquisitions, financial management, corporate finance, financial reporting, accounting, oversight of financial performance, and corporate governance.

Marvin R. Sambur, Ph.D. has served as a director of the Company since January 2007. Dr. Sambur started his career at Bell Laboratories in 1968 and later held top executive positions at ITT Corporation, including President and CEO of ITT Defense, a $2+ billion group with over 10,000 employees. From 2001 until 2005, Dr. Sambur served as Assistant Secretary of the United States Air Force for Acquisition and Research. In this position, Dr. Sambur formulated and executed a $220 billion Air Force investment strategy to acquire systems and support services. In 2015, Dr. Sambur retired from his position as Professor of the Practice at the University of Maryland’s Clark School of Engineering, a position he had held since 2005, and previously retired as the President and CEO of Burdeshaw Associates, a global defense/aerospace consulting company where he served from September 2012 to May 2013. Dr. Sambur is currently serving as the President of the Raptor Group, providing global consulting services on systems engineering issues. Dr. Sambur previously served on several Government Advisory Boards, including the U.S. Air Force Scientific Advisory Board and the National Academy of Science AF Study Board. Dr. Sambur received a Ph.D. from MIT in Electrical Engineering. Dr. Sambur has had over 100 papers published in referred journals on signal processing and Systems Engineering, and he developed the Master of Science in Systems Engineering program for The Clark School of Engineering at the University of Maryland.

Relevant experience and skills: senior operations and engineering management, high level executive and financial management, research and development management, government acquisitions management, and international negotiations.

Directors Whose Terms Will Continue After the Annual Meeting

Name | Age | Director Since | Term Expires | Position | ||||||||||

Lynn Brubaker | 59 | 2009 | 2018 | Director | ||||||||||

Simon Raab, Ph.D. | 64 | 1982 | 2018 | Director | ||||||||||

John E. Caldwell | 67 | 2002 | 2019 | Director | ||||||||||

John Donofrio | 55 | 2008 | 2019 | Director | ||||||||||

Lynn Brubaker has served as a director of the Company since July 2009. Ms. Brubaker is a seasoned executive with over 35 years’ experience in aviation and aerospace in a variety of executive, operations, sales, marketing, customer support and independent consultant roles. She has over 15 years of Board experience and over ten years of experience advising high technology, international, multi-industry and global companies. Since 2005, Ms. Brubaker has had an advisory practice focused on strategy and business development. She is currently a director of Hexcel Corporation, a New York Stock Exchange-listed company in leading advanced materials and technology, The Nordam Group, a private aerospace company in high technology manufacturing and repair, and QinetiQ Group plc, a London Stock Exchange–listed leading research and technology company. Ms. Brubaker also served on the board of directors of Force Protection, Inc., a developer and manufacturer of military survivability technology listed on the NASDAQ Stock Market (“NASDAQ”) from March 2011 until its merger with an affiliate of General Dynamics Corporation in December 2011. Ms. Brubaker spent 10 years at Honeywell International, retiring as Vice President and General Manager—Commercial Aerospace for Honeywell

International, a position she held from 1999 to 2005. Ms. Brubaker held a variety of management positions with McDonnell Douglas, Northwest Airlines, and ComAir. Ms. Brubaker currently serves on the board of a variety of private companies and other business organizations.

Relevant experience and skills: sales and marketing management, executive management, technology, business development, international operations, manufacturing, financial reporting, and audit, nominating and compensation committee experience.

Simon Raab, Ph.D. is a co-founder of the Company and has served as Chairman of the Board of Directors of the Company since its inception in 1982. Dr. Raab has served as our President and Chief Executive Officer since December 2015. Dr. Raab previously served as Chief Executive Officer of the Company from its inception in 1982 until January 2006, as Co-Chief Executive Officer from January 2006 until December 2006, and as President of the Company from 1986 until 2004. Dr. Raab also serves as a director of two privately-held companies: Cynvenio Biosystems, Inc. and True Vision Systems, Inc. Dr. Raab holds a Ph.D. in Mechanical Engineering from McGill University, Montreal, Canada, a Masters of Engineering Physics from Cornell University and a Bachelor of Science in Physics from the University of Waterloo, Canada.

Relevant experience and skills: executive management, mechanical engineering and physics.

John E. Caldwell has been a director of the Company since 2002. In March 2011, Mr. Caldwell retired as President and Chief Executive Officer and from the board of directors of SMTC Corporation (“SMTC”), a publicly heldpublicly-held electronics manufacturing services company whose shares are traded on the NASDAQNasdaq Global Market and on the TSX.Toronto Stock Exchange (“TSX”). Mr. Caldwell had served as President and CEO and as a director of SMTC since 2003. Before joining SMTC, Mr. Caldwell held positions in the Mosaic Group, a marketing services provider, as Chair of the Restructuring Committee of the Board of Directors from October 2002 to September 2003; in GEAC Computer Corporation Limited, a computer software company, as President and Chief Executive Officer from October 2000 to December 2001; and in CAE Inc., a provider of simulation technologies and integrated training solutions for the civil aviation and defense industries, as President and Chief Executive Officer from June 1993 to October 1999. In addition, Mr. Caldwell served in a variety of senior executive positions in finance, including Senior Vice President of Finance and Corporate Affairs of CAE and Executive Vice President of Finance and Administration of Carling O’Keefe Breweries of Canada. Over the course of his career, Mr. Caldwell has served on the audit committees of 11 public companies. Also, for the past several years, Mr. Caldwell has been an instructor on board risk oversight for the Institute of Corporate Directors in Canada. Mr. Caldwell is currently Chairman of the Board of Advanced Micro Devices, Inc., an innovative semiconductor provider, where he has served as a director since 2006. Mr. Caldwell has also been a director of IAMGOLD Corporation, a mid-tier gold producer, since 2006. Mr. Caldwell has also served on the board of directors of ATI Technologies Inc. from 2003 to 2006, Rothmans Inc. from 2004 to 2008, Cognos Inc. from 2000 to 2008, Stelco Inc. from 1997 to 2006 and Sleeman Breweries Ltd. from 2003 to 2005. Mr. Caldwell holds a Bachelor of Commerce degree and is a Chartered Professional Accountant.

served as Vice President and General Counsel for Honeywell Aerospace. Previously he was a Partner at Kirkland & Ellis LLP, where he worked from 1989 through 1996. Before joining Kirkland & Ellis LLP, Mr. Donofrio was a law clerk at the U.S. Court of Appeals for the Federal Circuit and he worked as a Patent Examiner at the U.S. Patent and Trademark Office.

| Name | Age | Director Since | Term Expires | Position | |||||

| Stephen R. Cole | 67 | 2000 | 2020 | Director | |||||

| Lynn Brubaker | 61 | 2009 | 2021 | Director | |||||

| Jeffrey A. Graves, Ph.D. | 57 | 2017 | 2021 | Director | |||||

| Simon Raab, Ph.D. | 66 | 1982 | 2021 | Director | |||||

reviews and approves operating, organizational, financial and strategic plans;

reviews our operational, financial and strategic performance;

oversees and evaluates management’s systems for internal control, financial reporting and public disclosure;

oversees our global risk management;

establishes corporate governance standards;

selects, evaluates and compensates our executive officers, including the President and CEO;

oversees and evaluates senior management performance and compensation; and

plans for effective development and succession of the President and CEO and senior management.

TheDirector, with Stephen R. Cole serving as Lead Director until May 2018 and John Donofrio serving as Lead Director from May 2018 until April 5, 2019. On April 5, 2019, the Board appointed Michael D. Burger as our President and CEO, andeffective June 17, 2019. On that same date, the Board elected John Donofrio as our independent Chairman of the Board, effective immediately. The Board believes that having an independent Chairman of the Board will allow Dr. Raab to focus on assisting Mr. Burger through this executive transition and will allow Mr. Burger to concentrate on overseeing the management of our business when he begins his service as our President and CEO, while Mr. Donofrio oversees the functioning of the Board and our corporate governance. Because we currently have an independent Chairman of the Board, there is currently no Lead Director.

|

|

|

| |||

Lynn Brubaker John E. Caldwell Stephen R. Cole* John Donofrio Jeffrey A. Graves, Ph.D. Yuval Wasserman | Lynn Brubaker John E. Caldwell Stephen R. Cole John Donofrio Jeffrey A. Graves, Ph.D. Yuval Wasserman* | Lynn Brubaker John E. Caldwell* Stephen R. Cole John Donofrio

Jeffrey A. Graves, Ph.D. Yuval Wasserman | Lynn Brubaker* John E. Caldwell Stephen R. Cole John Donofrio

Jeffrey A. Graves, Ph.D. Yuval Wasserman | |||

|

| |||

| * | Committee |

provide oversight regarding our accounting and financial reporting process, system of internal control, external and internal audit process, and our process for monitoring compliance with laws and regulations;

review the independence and qualifications of our independent public accountants and our financial policies, control procedures and accounting staff;

review and make appropriate inquiry of financial performance and financial position, including comparison of actual to budgeted results;

appoint and oversee our independent public accountants;

oversee internal audit and compliance functions;

review and approve our financial statements and other regulatory filings; and

review transactions between the Company and any officer or director, any entity in which an officer or director of the Company has a material interest, or any other related person transactions.

reviewing our operational performance against certain predetermined metrics; focusing on improving our short-term and long-term operating performance and continuously reviewing the metrics against which we measure our performance;Operational Audit CommitteeThe Operational Audit Committee met threefour times in 2016.2018. The Operational Audit Committee acts under the terms of a written charter that is available on our website atwww.faro.com, by first clicking “Investor Relations” and then “Leadership and Governance.”www.faro.com/about-faro/leadership-and-governance. The primary objective of the Operational Audit Committee is to provide operating insight to the Board so as to better enable the directors to discharge the Oversight Functions of the Board. In that context, the Operational Audit Committee’s role includes:

meeting with executives and department heads to review progress against operational goals; and

addressing operational risk management issues.

examination of management and leadership development and programs; review of the design of incentive plans; review and approval of senior management objectives; evaluation of the performance of all officers at the senior executive team level; making bonus and equity incentive award determinations in accordance with our short-term incentive plan and our long-term equity plan, respectively; establishment of executive compensation for addressing other compensation and employment matters, including specific review of the performance of our President and CEO; ensuring that the philosophy and operation of our compensation program reinforce our culture and values, create a balance between risk and reward, attract, motivate and retain executives over thelong-term and align their interests with those of our shareholders; overseeing our long-term equity plans, including reviewing and approving changes in such plans, granting equity awards to officers at the Vice President level and above reporting to the President and CEO, as well as approving the total amount of equity grants below the Vice President level and related parameters of such grants; advising on selection of certain executive officer positions; establishing the terms of all executive severance and reviewing and approving on an annual basis long-term and short-term corporate objectives relevant to the President and CEO’s compensation, evaluating the President and CEO’s performance not less than semi-annually in light of those objectives and, without the input or participation of the President and CEO, approving the individual components of, and the overall compensation levels for, the President and CEO based on such reviewing and approving, with the input and recommendation of the President and CEO, the annual base salaries, annual incentive and other compensation arrangements of all other named executive officers and all other Senior Vice Presidents and Vice reviewing and monitoring all compensation and significant benefit plans that affect all employees and annually approving overall employee salary policies, as well as equity-based programs for all levels of employees; reviewing and recommending any proposed changes in director compensation to the Board; reviewing and discussing with management the Compensation Discussion and Analysis that is included in our proxy statement for our annual meeting of shareholders; preparing the report of the Compensation Committee for inclusion in the proxy statement; and engaging, on an as-needed basis, the services of outside experts in areas of compensation and benefits practices. Specifically, the Compensation Committee has engaged be subject to all of the terms and conditions of the 2014 each director must display high personal and professional ethics, integrity and values; each director must have the ability to exercise sound business judgment and demonstrate basic financial literacy; each director must be highly accomplished in his or her respective field, with broad experience and demonstrated each director must have relevant expertise and experience, and be able to offer advice and guidance based on that expertise and experience; each director must be independent of any particular constituency, be able to represent all shareholders of the Company and be committed to enhancing long-term shareholder value; and each director must have sufficient time available to devote to activities of the Board and to enhance his or her knowledge of our business.Compensation CommitteeThe Compensation Committee held threefive meetings during 2016.2018. In addition to its formal meetings, the Compensation Committee Chairman and other members of the committee met frequently throughout 20162018 and in the first quarter of 20172019 among themselves without the presence of management, as well as with the Compensation Committee’s advisorsconsultant and our President and CEO. Areas of consideration at these various meetings included but were not limited to:consultations with Pearl Meyer & PartnersCompensia, Inc. (“Pearl Meyer”Compensia”), the compensation consultant to the Compensation Committee for 2018 and 2019 board and executive compensation, regarding, among other matters, updated market data and compensation trends generally and specific updated market data regarding compensation for the President and CEO and certain other named executives officers;20162018 and 2017, including, among other items, determination of the appropriate compensation for (i) Dr. Raab in connection with his commitment to extend his role as President and CEO beyond an interim basis, (ii) Kathleen J. Hall in connection with her appointment as our Chief Operating Officer in April 2016, (iii) Joseph Arezone in connection with his appointment as our Chief Commercial Officer in April 2016, and (iv) Robert E. Seidel, in connection with his appointment as our Chief Financial Officer in December 2016; anddeveloping the compensation arrangements and terms of our Chairman, President and CEO’s retirement and with respect to services to be provided by him during the transition period until his successor commences his employment; anddeveloping, with the advice of Compensia, Mr. Burger’s compensation arrangements and terms as our new President and CEO.Each of the Compensation Committee members qualifies as independent for Compensation Committee membership, as defined in the NASDAQNasdaq rules, as a non-employee director, as defined under Rule 16b-3 of the Exchange Act, and as an outside director, as defined under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).The Compensation Committee acts under the terms of a written charter that is available on our website atwww.faro.com, by first clicking “Investor Relations” and then “Leadership and Governance.”www.faro.com/about-faro/leadership-and-governance. As discussed in its charter, the Compensation Committee reviews our executive compensation policies and programs and endeavors to ensure they are aligned and implemented in accordance with our overall strategy, including enhancement of shareholder value. Although the Compensation Committee annually reviews and determines the President and CEO’s compensation, it works with the Chairman of the Board, President and CEO in evaluating the performance of all other officers at the Vice President level and above reporting to the President and CEO and in reviewing and approving annually all compensation programs and awards (including setting the base compensation for the upcoming year and approving bonus and equity incentive awards) for all officers at the Vice President level and above (other thanreporting to the CEO).President and CEO. The Compensation Committee maintains final authority in the determination of individual executive compensation packages to ensure compliance with our compensation policy objectives.The Compensation Committee’s duties and responsibilities include, among other things:change in controlchange-in-control benefits;evaluation;President levelPresident-level employees, including reviewing and approving on an annual basis long-term and short-term corporate objectives relevant to their performance evaluation and compensation, as well as approving the total amount of short-term incentives below the Vice President level and related parameters;monitoring compliance with requirements under the Sarbanes-Oxley Act of 2002 relating to 401(k) plans and loans to directors and officers and compliance with all other applicable laws affecting employee compensation and benefits;Pearl Meyer,Compensia, a compensation expert, to informally update the Compensation Committee on an annual basis and from time to time on matters that have been delegated to the Compensation Committee, and from time to time to provide a formal executivedirector compensation study and, directorin 2018, to provide a formal executive compensation study, including recommended best practices and median compensation at comparable companies.The Compensation Committee may delegate its authority to grant awards under the FARO Technologies, Inc. 2014 Incentive Plan (the “2014 Equity Plan”) to our executive officers. The Compensation Committee has delegated its authority to our President and CEO, subject to the parameters discussed below, to grant stock-based awards under the 2014 EquityIncentive Plan to newly-hirednewly hired employees, to current employees in connection with a promotion, and to employees recognized for performance under an established Company employee award program. The grants by our President and CEO are subject to the following parameters, among others, established by the Compensation Committee: (i) the President and CEO may not grant awards to (a) employees who are subject to the short-swing profit rules of Section 16 of the Exchange Act, or (b) employees who at the grant date are “covered employees,” or are reasonably anticipated to become “covered employees,” as defined in Section 162(m) of the Code, during the term of the award; (ii) any award granted by the President and CEO willEquityIncentive Plan; and (iii) the President and CEO must make a written report to the Compensation Committee at the end of each fiscal quarter that sets forth any and all awards granted by him during the preceding fiscal quarter.As earlier noted, the Compensation Committee has the authority to retain consultants and to obtain advice and assistance from external legal, accounting and other advisors at our expense. Since 2008,October 2017, the Compensation Committee has engaged Pearl MeyerCompensia to advise it on compensation matters. In performing its services, Pearl MeyerCompensia reports to and is instructed by the Compensation Committee. The Compensation Committee met with Pearl Meyer in December 2015. The Chairman of the Compensation Committee had additional conversations with Pearl Meyer during 2016 without management present. For more information regarding Pearl Meyer’sCompensia’s services, see “2016“2018 Director Compensation,” beginning on page 2118 of this Proxy Statement and “Executive Compensation—Compensation Discussion and Analysis,” beginning on page 3327 of this Proxy Statement.Governance and Nominating CommitteeThe Governance and Nominating Committee met one timefour times in 2016.2018. Each of the Governance and Nominating Committee members meetsis independent under the definition of independence in the NASDAQNasdaq rules.The Governance and Nominating Committee’s written charter is available on our website atwww.faro.com, by first clicking “Investor Relations” and then “Leadership and Governance.”www.faro.com/about-faro/leadership-and-governance. As discussed in detail in the charter, the Governance and Nominating Committee is responsible for developing, evaluating and implementing our corporate governance policies. The Governance and Nominating Committee is also responsible for selecting and recommending for Board approval director nominees and the members and chair of each of the Board committees. Current members of the Board are considered for re-election unless they have notified the Company that they do not wish to stand for re-election. The Governance and Nominating Committee considers candidates for the Board recommended by current members of the Board or members of management. In addition, the Committee may, to the extent it deems appropriate, retain a professional search firm and other advisors to identify potential nominees for director.The Governance and Nominating Committee also will consider director candidates recommended by eligible shareholders. Shareholders may recommend director nominees for consideration by the Governance and Nominating Committee by writing to the Governance and Nominating Committee, Attention: Chairman, 250 Technology Park, Lake Mary, Florida 32746, and providing appropriate biographical information concerning each proposed nominee. Candidates proposed by shareholders for nomination are evaluated using the same criteria as candidates initially proposed by the Governance and Nominating Committee.The following minimum qualifications must be met by a director nominee to be recommended by the Governance and Nominating Committee:senior levelsenior-level leadership in business, government, education, technology or public interest;

We may require any proposed nominee to furnish such other information as may reasonably be required to determine his or her eligibility to serve as an independent director or that could be material to a reasonable shareholder’s understanding of the nominee’s independence.

Communications with Board of Directors

Shareholders may communicate with the full Board or individual directors by submitting such communications in writing to FARO Technologies, Inc., Attention: Board of Directors (or the individual director(s)), 250 Technology Park, Lake Mary, Florida 32746. Communications should be sent by overnight or certified mail, return receipt requested. Such communications will be delivered directly to the Board or the individual director(s) designated on such communication.

Name | Fees Earned or Paid in Cash ($) (1) | Stock Awards ($) (2)(3) | All Other Compensation ($) | Total ($) | ||||||||||||

Lynn Brubaker | 67,500 | 99,978 | — | 167,478 | ||||||||||||

John E. Caldwell | 77,500 | 99,978 | — | 177,478 | ||||||||||||

Stephen R. Cole | 115,000 | 139,997 | — | 254,997 | ||||||||||||

John Donofrio | 72,500 | 99,978 | — | 172,478 | ||||||||||||

Marvin R. Sambur, Ph.D. | 72,500 | 99,978 | — | 172,478 | ||||||||||||

| Name | Fees Earned or Paid in Cash ($) (1) | Stock Awards ($) (2)(4) | All Other Compensation ($) | Total ($) | |||||||||

| Lynn Brubaker | 70,000 | 99,987 | — | 169,987 | |||||||||

| John E. Caldwell | 76,250 | 99,987 | — | 176,237 | |||||||||

| Stephen R. Cole | 96,250 | 99,987 | — | 196,237 | |||||||||

| John Donofrio | 90,000 | 139,972 | — | 229,972 | |||||||||

| Jeffrey A. Graves, Ph.D. | 67,500 | 99,987 | — | 167,487 | |||||||||

| Marvin R. Sambur, Ph.D. (3) | 54,375 | — | — | 54,375 | |||||||||

| Yuval Wasserman | 70,000 | 99,987 | — | 169,987 | |||||||||

| (1) | Includes cash retainers earned by each non-employee director during the year ended December 31, |

| (2) | Reflects the grant date fair value of restricted stock awards granted to our non-employee directors in |

| (3) | Effective May 11, 2018, Dr. Marvin R. Sambur retired from his position as a member of the Board of Directors in adherence with the Company’s mandatory retirement policy for directors, which requires a director who attains the age of 72 during his or her term to retire from the Board immediately prior to the first annual meeting of shareholders following such director’s 72nd birthday. |

| (4) | As of December 31, |

Name | Restricted Stock Awards (#) | |||

Lynn Brubaker | 1,883 | |||

John E. Caldwell | 1,883 | |||

Stephen R. Cole | 1,883 | |||

John Donofrio | 2,636 | |||

| Jeffrey A. Graves, Ph.D. | 3,903 | |||

Marvin R. Sambur, Ph.D. | — | |||

| Yuval Wasserman | ||||

| 3,903 |

Name | Restricted Stock Awards (#) | Full Grant Date Fair Value of Award ($) | ||||||

Lynn Brubaker | 2,988 | 99,978 | ||||||

John E. Caldwell | 2,988 | 99,978 | ||||||

Stephen R. Cole | 4,184 | 139,997 | ||||||

John Donofrio | 2,988 | 99,978 | ||||||

Marvin R. Sambur, Ph.D. | 2,988 | 99,978 | ||||||

| Name | Restricted Stock Awards (#) | Full Grant Date Fair Value of Award ($) | ||||

| Lynn Brubaker | 1,883 | 99,987 | ||||

| John E. Caldwell | 1,883 | 99,987 | ||||

| Stephen R. Cole | 1,883 | 99,987 | ||||

| John Donofrio | 2,636 | 139,972 | ||||

| Jeffrey A. Graves, Ph.D. | 1,883 | 99,987 | ||||

| Yuval Wasserman | 1,883 | 99,987 | ||||

2018.

Annual Cash Retainer: | $ | 40,000 | ||

Additional Annual Retainers: | ||||

Governance and Nominating Committee Chairperson | $ | 10,000 | ||

Operational Audit Committee Chairperson | $ | 10,000 | ||

Audit Committee Chairperson | $ | 20,000 | ||

Compensation Committee Chairperson | $ | 15,000 | ||

Governance and Nominating Committee Non-Chair Member | $ | 5,000 | ||

Operational Audit Committee Non-Chair Member | $ | 5,000 | ||

Audit Committee Non-Chair Member | $ | 10,000 | ||

Compensation Committee Non-Chair Member | $ | 7,500 | ||

Lead Director | $ | 80,000 | (a) | |

Chairman | $ | 100,000 | (a) | |

Initial Equity Grant | $ | 100,000 | (b) | |

Annual Equity Grant | $ | 100,000 | (c) |

| Annual Cash Retainer: | $ | 40,000 | |||

| Additional Annual Retainers: | |||||

| Governance and Nominating Committee Chairperson | $ | 10,000 | |||

| Operational Audit Committee Chairperson | $ | 10,000 | |||

| Audit Committee Chairperson | $ | 20,000 | |||

| Compensation Committee Chairperson | $ | 15,000 | |||

| Governance and Nominating Committee Non-Chair Member | $ | 5,000 | |||

| Operational Audit Committee Non-Chair Member | $ | 5,000 | |||

| Audit Committee Non-Chair Member | $ | 10,000 | |||

| Compensation Committee Non-Chair Member | $ | 7,500 | |||

| Lead Director | $ | 80,000 | (a) | ||

| Non-Employee Chairman | $ | 100,000 | (a) | ||

| Initial Equity Grant | $ | 100,000 | (b) | ||

| Annual Equity Grant | $ | 100,000 | (c) | ||

| (a) | Payable 50% in cash and 50% in shares of restricted stock. Shares of restricted stock will be granted annually on the day following the annual meeting of shareholders, and the number of shares to be granted will be determined by dividing the dollar value of the retainer by the closing price of our common stock on the date of grant. The shares of restricted stock will vest on the day prior to the following year’s annual meeting date, subject to the Lead Director’s or non-employee Chairman’s, as applicable, continued membership on the Board as of such date. |

| (b) | Upon election to the Board, each non-employee director will receive shares of restricted stock with a value equal to $100,000, calculated by using the closing price of our common stock on the date of the non-employee director’s election to the Board. The initial restricted stock grant vests on the third anniversary of the grant date, subject to the non-employee director’s continued membership on the Board as of such date. |

| (c) | On the day following the annual meeting of shareholders, each director receives shares of restricted stock with a value equal to that indicated in the above chart, calculated by using the closing price of our common stock on the day following the annual meeting of shareholders. The annual restricted stock grant vests the day prior to the following year’s annual meeting date, subject to a director’s continued membership on the Board as of such date. |

In February 2017, after evaluating Dr. Raab’s role as our President and Chief Executive Officer and as a Director and Chairman of the Board, the Compensation Committee approved an increase of Dr. Raab’s base salary to $750,000, while removing his eligibility to receive the director and Chairman cash retainers and equity grants described above.

requirement, with the exception of Dr. Graves and Mr. Wasserman, who have through December 31, 2019 to attain the minimum share ownership requirement. FIRM FOR 2019. 2019. Audit fees(1) Audit related fees(2) All other fees Total fees this Proxy Statement.Mandatory Board of Director Stock Ownership and Holding PeriodsOur non-employee directors are subject to minimum share ownership guidelines. Within two years after joining the Board, each non-employee director is required to own shares of our common stock with a value equal to at least $300,000. The ownership requirement may be satisfied through (i) holdings of equity awards granted by us, the values of which are calculated based on the higher of (a) the then currentthen-current value of the equity awards on the date of determining compliance with the minimum share ownership guidelines and (b) the grant date fair value of the equity awards, and/or (ii) shares of common stock purchased by the non-employee director independently, the values of which are calculated based on the closing price of our common stock on the purchase date. Also, each non-employee director must hold shares of our common stock acquired pursuant to the exercise of stock options or vesting of restricted stock for one year after exercise or vesting, as applicable, or until his or her retirement, whichever is earlier. In 2012, the Board amended the holding period requirement to permit sales by non-employee directors to the extent necessary to satisfy tax obligations arising from the vesting of their restricted stock awards. As of December 31, 2016,2018, all of our directors were in compliance withmet or exceeded the minimum share ownership guidelines.Director Deferred Compensation PlanIn October 2018, the Compensation Committee approved the adoption of the FARO Technologies, Inc. 2018 Non-Employee Director Deferred Compensation Plan (the “Deferred Compensation Plan”). This plan encourages our directors to hold a substantial portion of their compensation in the form of equity, which can only be monetized at the end of their tenure on the Board or in other limited circumstances.Prior to the first day of each calendar year beginning on or after January 1, 2019, each non-employee director may (i) elect to convert all of his or her annual cash retainer fees as well as any annual committee and chair fees other than reimbursements otherwise payable to him or her by the Company into deferred stock units, and (ii) elect to receive all of his or her annual equity grant received during the calendar year in the form of restricted stock units, or defer payment of all such restricted stock units granted to the non-employee director in the calendar year. Each deferred stock unit represents the right to receive one share of our common stock no later than 60 business days following the date the non-employee director incurs a separation of service from the Company, or, in limited circumstances upon a change in control of the Company, cash equal to the fair market value of one share of our common stock on the date of the change in control, pursuant to the 2014 Incentive Plan and the Deferred Compensation Plan.PROPOSAL 2RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMTHE BOARD OF DIRECTORS RECOMMENDS THAT OUR SHAREHOLDERS VOTE “FOR” PROPOSAL 2, THE RATIFICATION OF GRANT THORNTON LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.The Sarbanes-Oxley Act of 2002 requires the Audit Committee to be directly responsible for the appointment, compensation and oversight of the audit work of our independent registered public accounting firm. Grant Thornton LLP has audited our financial statements for the fiscal years ended December 31, 2016 and 2015.since 2004. The Audit Committee has appointed Grant Thornton LLP as our independent registered public accounting firm for 2017.Representatives of Grant Thornton LLP will be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions of shareholders.Shareholders are not required to ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm. However, we are submitting the ratification to our shareholders as a matter of good corporate practice. If our shareholders fail to ratify the appointment of Grant Thornton LLP, the Audit Committee may reconsider the retention of Grant Thornton LLP. Even if the selection of Grant Thornton LLP is ratified, the Audit Committee in its discretion may select a different independent accounting firm at any time during the year if it determines that such change would be in the best interests of the Company and our shareholders.The affirmative vote of a majority of the votes cast is necessary for approval of the ratification of Grant Thornton LLP. Abstentions will have no impact on the ratification of our independent registered public accounting firm. Because this matter is a routine proposal, there will be no broker non-votes associated with this proposal.INDEPENDENT PUBLIC ACCOUNTANTSThe following table presents fees for professional audit services rendered by Grant Thornton LLP for the audit of our financial statements for the fiscal years ended December 31, 20162018 and 2015,2017, and fees for other services rendered by Grant Thornton LLP during those periods. 2016 2015 $ 1,805,569 $ 2,093,606 33,155 90,208 — — $ 1,838,724 $ 2,183,814 2018 2017 Audit fees (1) $ 1,818,514 $ 1,934,954 Audit-related fees (2) 32,552 35,740 Tax fees — — All other fees — — Total fees $ 1,851,066 $ 1,970,694 (1) Amounts for 20162018 and 20152017 include the audit of financial statements, review of financial statements included in Quarterly Reports on Form 10-Q, audit of the effectiveness of our internal control over financial reporting and statutory audits required internationally. AuditAlso, the amount for 2018 includes fees for 2016 decreased from 2015 primarily due toincurred in connection with our implementation of SAP, a new enterprise resource planning system,registration statement on Form S-8 filed with the SEC in theAsia-Pacific and Europe/Africa regions in 2015.August 2018.(2) Amounts for 20162018 and 20152017 include fees related to the audit of our employee benefit plan. Audit related fees included an evaluation of our SAP readiness in Europe/Africa in 2015.The Audit Committee has concluded that the provision of the audit and permitted non-audit services by Grant Thornton LLP in 20162018 and 20152017 is consistent with maintaining the independence of Grant Thornton LLP.Pursuant to the Audit Committee charter, the Audit Committee pre-approved all such services provided by Grant Thornton LLP. The Audit Committee has established pre-approval policies and procedures with respect to audit and permitted non-audit services to be provided by our independent auditors. Pursuant to these policies and procedures, the Audit Committee may form and delegate authority to subcommittees consisting of one or more members, when appropriate, to grant such pre-approvals, provided that decisions of such subcommittee(s) to grant pre-approvals are presented to the full Audit Committee at its next scheduled meeting. The Audit Committee’s pre-approval policies do not permit the delegation of the Audit Committee’s responsibilities to management.REPORT OF THE AUDIT COMMITTEEUnder the Audit Committee charter, the Audit Committee is responsible for overseeing the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the system of internal control over financial reporting and the financial reporting process. The independent accountants have the responsibility to express an opinion on the financial statements based on an audit conducted in accordance with generally accepted auditing standards. The Audit Committee has, among other things, the responsibility to monitor and oversee these processes.The Audit Committee has:(1) reviewed and discussed the Company’s audited financial statements with management;(2) discussed with the independent auditors the matters required to be discussed by the applicable rules of the Public Company Accounting Oversight Board; and(3) received the written disclosures and the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence.The Audit Committee also considered the impact of non-audit services on the auditor’s independence.The Audit Committee reviewed with the independent accountants the overall scope and specific plans for its audit. Without management present, the Committee met with the independent accountants to review the results of their examinations, their evaluation of the Company’s internal control over financial reporting, and the overall quality of the Company’s accounting and financial reporting. The Audit Committee reviewed and discussed the Company’s audited financial statements with the independent accountants.Based on the review and discussions described above, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 20162018 for filing with the SEC.Audit Committee:Stephen R. Cole, Audit Committee Member (Chair)Lynn Brubaker, Audit Committee MemberJohn E. Caldwell, Audit Committee Member (Chair)Lynn Brubaker, Audit Committee MemberStephen R. Cole, Audit Committee MemberJohn Donofrio, Audit Committee MemberMarvin R. Sambur,Jeffrey A. Graves, Ph.D., Audit Committee MemberYuval Wasserman, Audit Committee MemberPROPOSAL 3ADVISORY VOTE ON EXECUTIVE COMPENSATIONTHE BOARD OF DIRECTORS RECOMMENDS THAT OUR SHAREHOLDERS VOTE “FOR” PROPOSAL 3, THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.Section 14A of the Exchange Act provides shareholders with the opportunity to vote to approve, on a non-binding advisory basis, the compensation of our named executive officers. This advisory vote is commonly known as “Say-on-Pay.” Accordingly, the Board of Directors is asking our shareholders to indicate their support for the compensation of our named executive officers, as disclosed in this Proxy Statement.This proposal is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and our executive compensation program and practices. The Compensation Committee endeavors to ensure that the philosophy and operation of our compensation program reinforces our culture and values, creates a balance between risk and reward, attracts, motivates, and retains executives over the long-term and aligns their interests with those of our shareholders. The Compensation Committee strives to provide total compensation relating to the President and CEO, the other named executive officers and all other employees at the Vice President level and above, that is fair, reasonable and achieves the objective described above. Our executive compensation program includes a significant performance-based component, in the form of a short-term annual incentive award, as well as a substantial emphasis on “at-risk,” equity-based long-term incentives. Please read the Compensation Discussion and Analysis, together with the related compensation tables and narrative disclosure below, for a detailed explanation of our executive compensation program and practices.At our annual meetings of shareholders held in May 2014,2016, May 20152017 and May 2016,2018, approximately 98%, 99% and 78%, respectively, of the votes cast on the Say-on-Pay proposal at each of those meetings were voted in favor of the proposal. The Compensation Committee believes this affirmsDuring 2018, before our shareholders’ support forannual meeting of shareholders, our approach tomanagement team discussed our executive compensation programs, policies and no significant changes were made to this approach for 2016 aspractices with certain of our shareholders. As a result of the voteslower say-on-pay approval level in prior years. However,2018, and based on observations fromthe discussions management had with those shareholders during 2018, the Compensation Committee’sCommittee decided to undertake a comprehensive review of our executive compensation programs, policies and practices, including engaging its independent compensation consultant Pearl Meyer, which were consistent with those shared by managementto assist in the review of our 2018 say-on-pay voting results, shareholder outreach considerations and by certain investors who have communicated concerns torecommendations for the Company with respect to such incentive programs, the Compensation Committee:adopted a simpler short-term cash incentive plan beginning in 2016, in which awards for executives could be earned based on achievement of financial performance goals for revenue (30%) and profitability (70%), which amount would then be multiplied by an individual performance factor normalized at 1.0; andtransitioned to a simpler long-term equity incentive program that granted time-based equity incentive awards consisting of stock options and restricted stock units, with the number of awards granted to each participant based on his or her targeted2019 long-term equity incentive award percentage, multiplied by an individual performance factor normalized at 1.0.The effectdesign. As a result of this initiative, the individual performance factor would beCompensation Committee approved significant changes to adjust,our executive compensation to more closely align with current best practices, respond to shareholder concerns regarding the pay-for-performance features of our executive compensation programs, and strengthen the pay-for-performance alignment of our executive compensation programs. For more information regarding the changes made to our executive compensation program, see “Executive Compensation—Compensation Discussion and Analysis—Consideration of Prior Year Say-on-Pay Vote,” beginning on a performance basis, the amount otherwise determined upward or downward based upon achievementpage 28 of individual objectives, performance against operational metrics assigned to the executive for each quarter in the prior year as well as for the full prior year and overall contribution for the year, without ascribing specific percentages to each category.The Board is asking our shareholders to vote “FOR” the following non-binding resolution:“Resolved, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis and the related compensation tables and narrative disclosure, in the Proxy Statement is hereby approved on an advisory basis.”The approval of this proposal requires the affirmative vote of a majority of the votes cast by the shareholders. Abstentions and broker non-votes will have no impact on the outcome of this matter. As an advisory vote, the result will not be binding on the Board; however, the Compensation Committee, which is comprised solely of independent directors, will consider the outcome of the vote when evaluating the effectiveness of our compensation policies and practices.PROPOSAL 4

ADVISORY VOTE ON THE FREQUENCY OF THE APPROVAL OF EXECUTIVE COMPENSATION

THE BOARD OF DIRECTORS RECOMMENDS THAT OUR SHAREHOLDERS VOTE “1 YEAR” FOR THE NON-BINDING VOTE TO APPROVE THE FREQUENCY OF FUTURE NON-BINDING VOTES TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

Section 14A of the Exchange Act also provides our shareholders with the opportunity to indicate, on a non-binding advisory basis, how frequently we should hold future advisory “Say-on-Pay” votes. Accordingly, the Board is asking our shareholders to express their preference as to the frequency with which the we should present future “Say-on-Pay” votes to shareholders. Shareholders may select a frequency of every one, two or three years, or they may abstain from voting.

We are required to hold this “Say-on-Pay” frequency vote at least once every six calendar years. When we conducted our last “Say-on-Pay” frequency vote at our 2011 Annual Meeting of Shareholders, our shareholders expressed a strong preference to conduct “Say-on-Pay” votes on an annual basis. Consistent with that preference, since that time, we have continued to hold our “Say-on-Pay” vote annually. The Board has not observed any reason why the previously-expressed shareholder preference should not continue to govern and notes that market practice is for annual “Say-on-Pay” votes. The Board believes that an annual “Say-on-Pay” vote will allow shareholders to provide the Board and the Compensation Committee with more meaningful and direct input into our executive compensation philosophy, policies and programs. The Board believes an annual “Say-on-Pay” vote will also foster more useful communication with shareholders by providing shareholders with a clear and timely means to express any concerns and questions. Nonetheless, shareholders are not being asked to approve or disapprove of the Board’s recommendation, but rather to indicate their own choice as among the frequency alternatives.

The non-binding selection of one of the three frequency options requires the affirmative vote of a majority of the votes cast by the shareholders. If none of the frequency options receives the approval of a majority of the votes cast, the Board will view as the selection of shareholders the frequency alternative that receives the greatest number of votes. Although this vote is advisory and not binding, the Board values the opinions of our shareholders and will consider the outcome of this proposal when determining the frequency of future “Say-on-Pay” votes.

OTHER MATTERS TO COME BEFORE THE ANNUAL MEETING

The Board of Directors and management do not know of any matters before the Annual Meeting other than those to which we refer in the Notice of Annual Meeting and this Proxy Statement. If any other matters properly come before the Annual Meeting, the proxy holders will vote the shares in accordance with their best judgment. To bring business before an Annual Meeting, a shareholder must give written notice to our Secretary before the meeting and comply with the terms and time periods specified in our bylaws and described under “Deadline for Receipt of 2018 Shareholder Proposals and Director Nominees.” No shareholder has given written notice that he or she intends to bring business before the Annual Meeting in compliance with the terms and time periods specified in our bylaws.